Nita Kejriwal: On average, each cluster-level federation consists of 30 village organizations, 450 self-help groups (SHGs), and 5,000 members. The goal is to enhance capacity, provide support, and encourage self-reliance. Our aim is to establish 1,500 model cluster federations that can serve as examples for other similar federations. These federations are currently engaged in financial activities through Community Investment Funds. Some well-established federations have significant funds that they lend to their members. While this work continues, we are also focusing on building relationships with banks and providing credit support for other financial services. These federations assist members in planning for livelihoods, support Farmer Producer Organisations (FPOs), engage in negotiations with markets, help members access government entitlements, and have partnerships with e-commerce retailers like Amazon. They also advocate for member demands in various forums and have established Gender Justice Centres.

Chetna Sinha: The women who founded the Mann Deshi Sahakari Bank made a powerful statement by saying, “We may not know how to read and write, but we can count.” This highlights the financial acumen and mutual support among grassroots women. Women vendors now come together to guarantee loan repayments and are venturing into individual entrepreneurship. Our goal is to impact one million women entrepreneurs, each creating 10 jobs, resulting in a total of 10 million jobs. This demonstrates the immense potential at the grassroots level.

Anjini Kochar: India has made significant progress in financial inclusion since 2012, with states like Bihar showing high percentages of women with access to savings accounts. The National Rural Livelihood Mission (NRLM) and self-help groups have played a crucial role in this improvement, encouraging women to open their own accounts. The focus now is on translating financial access into economic growth and ensuring that benefits reach those intended. Strategies like the Indira Gandhi Matritva Sahyog Yojana (IGMSY) in Bihar are helping direct credits to women’s accounts, although challenges like misuse of funds still exist.

Bijal Brahmbhatt: The Mahila Housing Trust aims to empower poor women in the informal sector by improving their housing, living conditions, and negotiating skills with the government and private sector. By providing access to essential services like water and sanitation through network solutions, we strive to reduce inequality and empower women to advocate for their rights.

A woman from each household is elected to represent community action groups, trained to navigate urban governance systems. This initiative has expanded to include legal electricity access, housing finance, and land rights. By engaging with women on climate change issues, we aim to co-create solutions and leverage technology to mitigate environmental impacts. These efforts have mobilized 125,000 families in the fight against climate change.

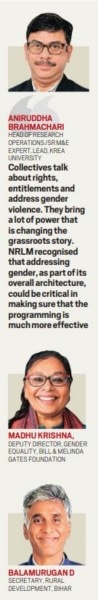

Madhu Krishna: Recent evaluations of NRLM have shown a 19% increase in incomes, a 20% decrease in informal loans, and higher household savings. Initiatives like SHGs running fecal sludge treatment plants (FSTPs) are being replicated in other states, contributing to productive asset creation and economic empowerment for women. Convergence between schemes like MNREGA and SHGs is expected to be a game-changer in the future.

Balamurugan D: The Jeevika project, funded by the World Bank, has facilitated over Rs 21,000 crore in bank credit for women, lifting many out of poverty. By targeting ultra-poor families through initiatives like the Satat Jeevikoparjan Yojana (SJY) in Bihar, we aim to provide coaching, grants, and support money to help them transition to sustainable livelihoods. Through community-based selection processes, we minimize errors and ensure inclusivity in our programs, resulting in significant improvements in the financial stability of participating families.

Hasina Kharbhih: Our model, implemented in the Northeast and neighboring countries, promotes traditional skills among indigenous women to reduce migration and human trafficking risks. By reviving traditional crafts and providing market access, women can earn sustainable incomes from home-based work. This approach has led to substantial income gains for women and empowered them in their households.

Chetna Sinha: Access to capital is a key challenge for women entrepreneurs, even within SHGs. Mann Deshi Bank provides financial support through grants and equity from wealthy women, enabling women to invest in their businesses and upgrade to higher business structures. Digital innovations like Mera Khata and Mera Bill are helping women manage finances effectively and transition to more advanced business models.

Madhu Krishna: NRLM’s digital infrastructure is being strengthened to track credit linkages and provide enterprise support to women entrepreneurs. By leveraging data and credit histories, we aim to scale up support for multiple cluster-level federations and enhance their business capabilities.

Giriraj Singh, Minister of Rural Development and Panchayati Raj: My mission is to ensure that every rural woman has access to the National Rural Livelihood Mission (NRLM) to enhance their financial well-being. With 8.35 crore women connected to NRLM and substantial bank linkages, we are working towards improving the turnover of 5.9 lakh crore women, who will play a significant role in boosting national GDP.

These revised versions aim to enhance clarity, readability, and conciseness while maintaining the original meaning and intent of the text.

+ There are no comments

Add yours